NCR Registered, Debt Review & solutions – South Africa

We specialize in debt review to help you regain control of your life

Why Debt Review?

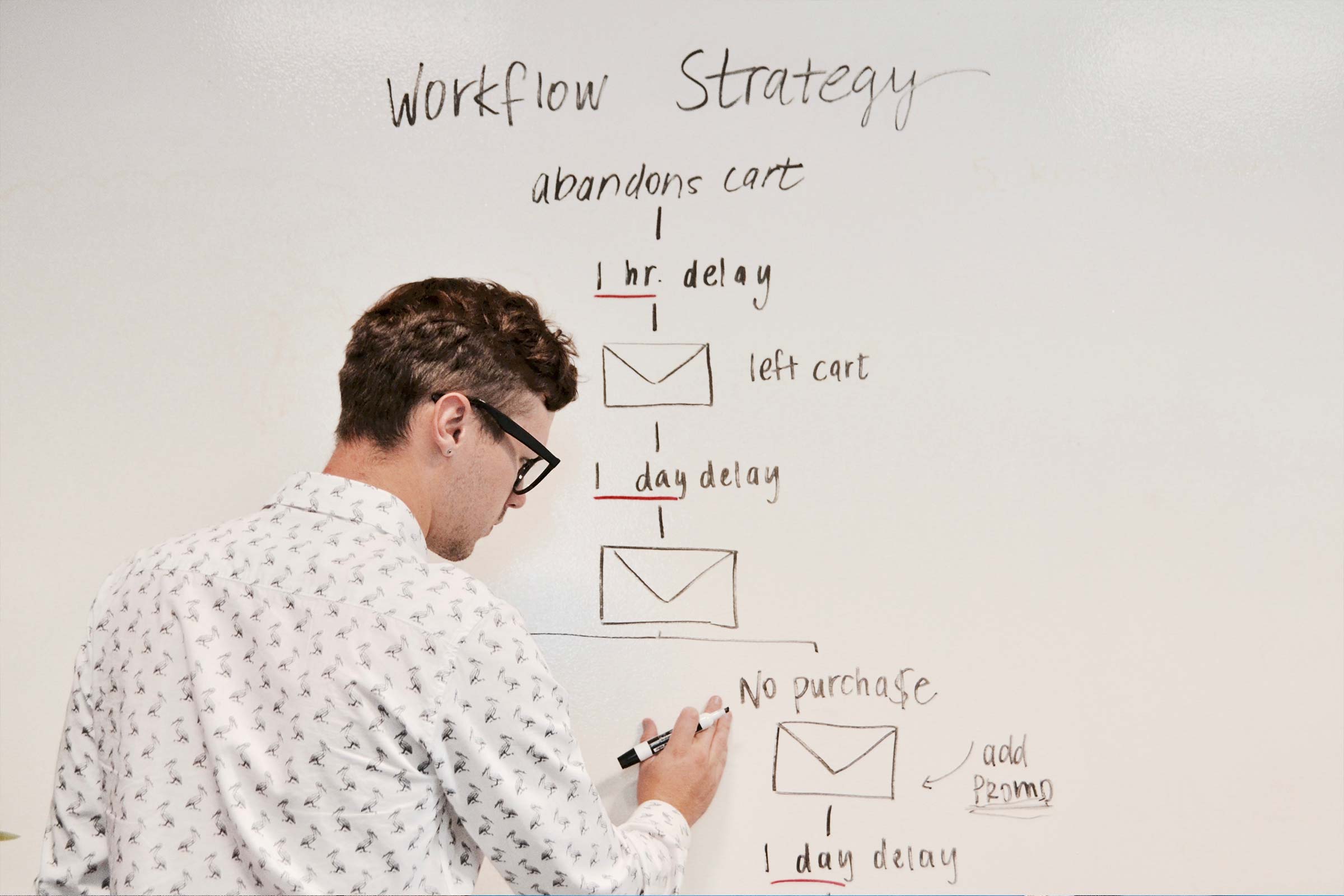

By working with our NCR registered debt review counsellor, we negotiate lower interest rates, restructure debt into manageable payments, and protect you & your assets from legal action by creditors (like creditor harassment, asset repossession and stop garnishee order).

Our dedicated team will support you every step of the way, ensuring you regain control of your finances and work towards a debt-free future.

Reduced Debt Payment

| Debt Class | Old Payment | New Payment | Total Savings |

|---|---|---|---|

| Property Bond | R 9,200.00 p/m | R 7,100.00 p/m | R 2,100.00 p/m |

| Vehicle Finance | R 4,800.00 p/m | R 3,250.00 p/m | R 1,550.00 p/m |

| Credit & Store Cards | R 6,100.00 p/m | R 2,500.00 p/m | R 3,600.00 p/m |

| Personal Loans | R 5,400.00 p/m | R 2,900.00 p/m | R 2,500.00 p/m |

| Total | R 25,500.00 p/m | R 15,750.00 p/m | R 9,750.00 p/m |

| Debt Class | Old Payment |

|---|---|

| Property Bond | R 9,200.00 p/m |

| Vehicle Finance | R 4,800.00 p/m |

| Credit & Store Cards | R 6,100.00 p/m |

| Personal Loans | R 5,400.00 p/m |

| Total | R 25,500.00 p/m |

| Debt Class | New Payment |

|---|---|

| Property Bond | R 7,100.00 p/m |

| Vehicle Finance | R 3,250.00 p/m |

| Credit & Store Cards | R 2,500.00 p/m |

| Personal Loans | R 2,900.00 p/m |

| Total | R 15,750.00 p/m |

| Debt Class | Total Savings |

|---|---|

| Property Bond | R 2,100.00 p/m |

| Vehicle Finance | R 1,550.00 p/m |

| Credit & Store Cards | R 3,600.00 p/m |

| Personal Loans | R 2,500.00 p/m |

| Total | R 9,750.00 p/m |

Estimate Your Reduced Debt Payment

3. Get Debt Free

You will start making the reduced payments under debt review according to the new plan. During this period, you are protected from legal action by your creditors, giving you peace of mind.

As you make these manageable payments, you’ll steadily work towards clearing your name. Once most of your debts are paid off, you will receive a clearance certificate from your debt counsellor.

This certificate marks the successful completion of the debt review process and helps restore your financial standing with the National Credit Regulator, giving you a fresh start and renewed financial freedom.

Our Trusted Consultants

Empowering clients with knowledge and tools needed to regain control of their finances. Your financial freedom is my mission.

Financial Assessor

Every client’s situation is unique, and I am dedicated to finding personalized solutions that lead to lasting financial stability.

Senior Financial Consultant

My goal is to provide compassionate support and expert guidance, helping clients navigate their debt journey with confidence and peace of mind

Eye-Opening Facts About Debt in South Africa

Understanding the landscape of debt in South Africa is important for making informed financial decisions. You can better navigate your own financial journey and seek appropriate debt management solutions when needed.

Why Us

We understand the emotional toll that financial struggles can take on your life. Our mission is to provide you with the relief and support you need to regain control of your finances and your future.

Our compassionate and experienced team is dedicated to guiding you through every step of the debt relief process, offering personalized solutions tailored to your unique situation.

We believe in a transparent, supportive approach that empowers you to achieve lasting financial freedom and peace of mind.

We Build Relationships

We believe strong relationships are the foundation of successful debt relief. We take the time to understand your unique financial situation and work closely with you to develop a personalized plan.

Transparent and Honest Communication

Transparency and honesty are at the core of our values. We believe in clear and open communication, ensuring you fully understand every aspect of your debt relief plan.

Your Success is Our Priority

Your financial success is at the heart of everything we do. We are dedicated to helping you overcome your debt challenges and achieve your financial goals.

What our Customers have to say

100/100 debt review service

“I just want to start off by saying thank u too Debt Lite Solutions. They helped me so much with my vehicle which was on the verge of being repossessed and the consultant had the best service.

He had so much patients with me just one of the best companies, I would refer them anytime – 100/100“

“I just want to start off by saying thank u too Debt Lite Solutions. They helped me so much with my vehicle which was on the verge of being repossessed and the consultant had the best service.

He had so much patients with me just one of the best companies, I would refer them anytime – 100/100“

Thabo M

Seize the Moment – Debt Review, Your Journey to Financial Freedom!

“Debt is not the end of your story. It’s just a chapter. Let’s turn the page together.”

DebtLite Solutions – Founder