When financial troubles strike, many individuals find themselves grappling with overwhelming debt. Debt review and debt consolidation emerge as two popular options for those seeking financial assistance. These approaches offer hope to those drowning in debt, providing potential pathways to regain control of their finances and move towards a more stable future.

Understanding the key differences between debt review and debt consolidation is crucial for making an informed decision. This article aims to shed light on both processes, exploring their unique features and benefits. By examining how each method works, its impact on credit scores, and its suitability for different financial situations, readers will gain valuable insights to help them choose the most appropriate debt management strategy for their needs.

Understanding Debt Review

What is debt review?

Debt review, also known as debt counseling, is a legal process introduced in South Africa in 2007 under the National Credit Act. It aims to assist individuals who are struggling to repay their debts, including mortgages, car loans, credit cards, and other accounts. This process is regulated by the National Credit Regulator (NCR) and provides relief to those overwhelmed by debt.

When someone applies for debt review, a registered Debt Counselor assesses their income and expenses to determine if they are over-indebted. If so, the Debt Counselor develops a repayment plan to help manage the individual’s debts more effectively.

The debt review process

- Application: The process begins when an individual completes an application form (Form 16) with a registered Debt Counselor.

- Assessment: The Debt Counselor evaluates the applicant’s financial situation, including income, expenses, and debts.

- Negotiation: The Debt Counselor negotiates with creditors to reduce interest rates and extend repayment terms.

- Repayment plan: A restructured repayment plan is created, consolidating all debts into a single, manageable monthly payment.

- Legal protection: The Debt Counselor approaches the court to obtain a court order, providing legal protection for the individual’s assets.

- Payment distribution: A registered Payment Distribution Agency (PDA) handles the monthly payments, distributing funds to creditors on behalf of the individual.

- Completion: Once all debts are repaid, the Debt Counselor issues a clearance certificate, and the credit bureaus are notified.

Benefits of debt review

Debt review offers several advantages to individuals struggling with financial problems:

- Legal protection: It shields individuals from creditor harassment and legal actions, including repossessions.

- Simplified payments: Consolidates multiple debts into a single, manageable monthly installment.

- Reduced interest rates: Debt Counselors negotiate lower interest rates with creditors, potentially saving money on the total debt amount.

- Asset protection: Safeguards important assets like homes and vehicles from repossession.

- Financial education: Provides counseling and education to improve money management skills.

- Stress reduction: Alleviates the stress of dealing with multiple creditors and overwhelming debt.

- Clean slate: Upon completion, individuals receive a clearance certificate and can rebuild their credit profile.

While debt review has numerous benefits, it’s important to note that individuals cannot apply for new credit during the process. However, this restriction is temporary and helps focus on eliminating existing debt.

Exploring Debt Consolidation

Definition of debt consolidation

Debt consolidation is a financial strategy that involves combining multiple debts into a single, larger loan. This approach aims to simplify repayment by reducing the number of creditors an individual has to deal with. It’s a popular method for managing various types of consumer debt, including credit card balances, personal loans, medical bills, and even student loans.

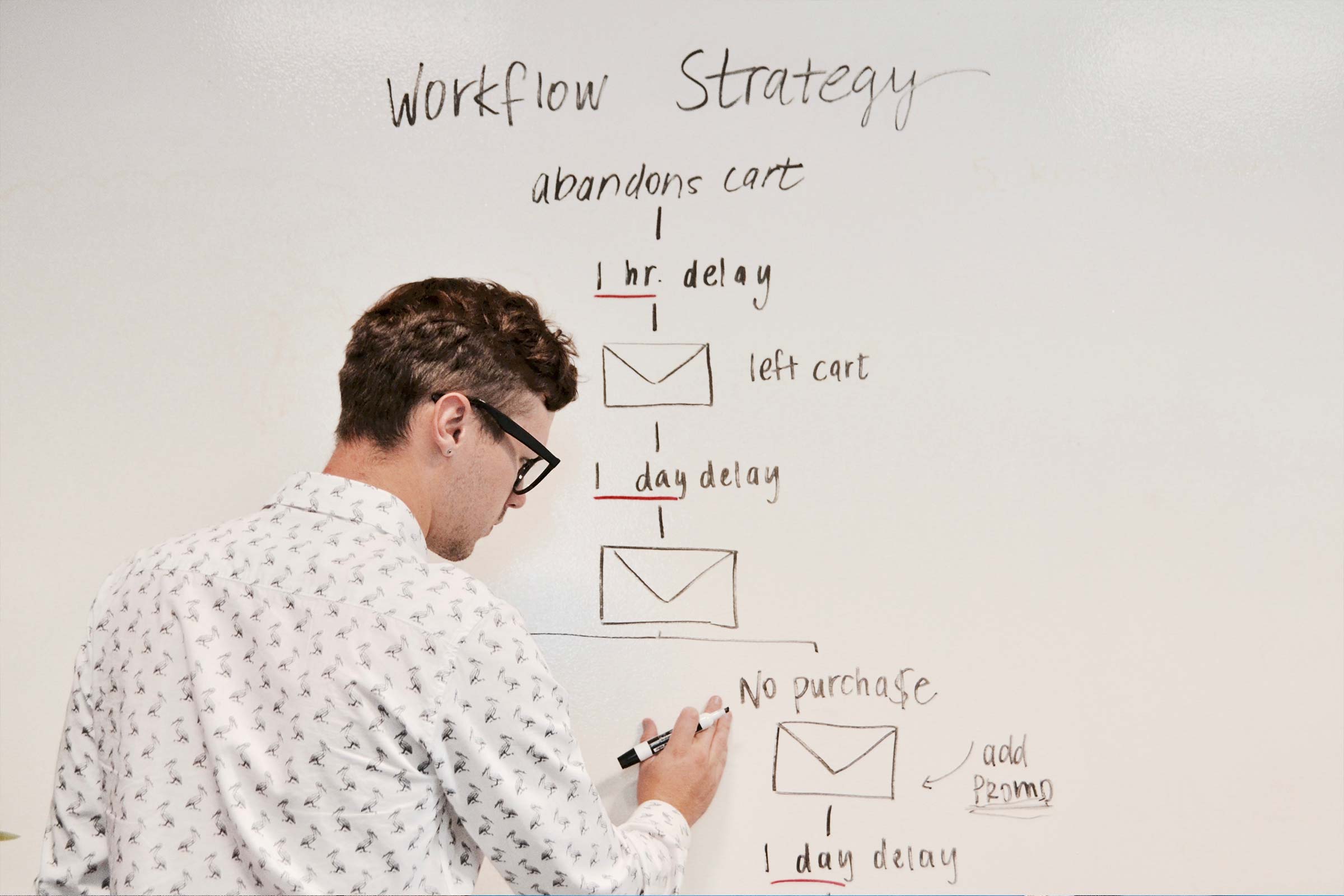

How debt consolidation works

The process of debt consolidation typically involves taking out a new loan or credit card to pay off existing debts. Here’s how it generally works:

- Assess total debt: The individual adds up the amounts owed on all their debts.

- Apply for a new loan: They then apply for a consolidation loan or a balance transfer credit card with a credit limit high enough to cover the total debt.

- Pay off existing debts: Once approved, the funds from the new loan are used to settle all the existing debts.

- Manage single payment: The individual is then left with one loan to repay, typically with a fixed repayment schedule and interest rate.

Some people opt to use home equity loans for debt consolidation, while others might choose personal loans or balance transfer credit cards with promotional low or 0% interest rates.

Advantages of debt consolidation

Debt consolidation offers several potential benefits:

- Simplified finances: By reducing multiple debts to a single monthly payment, it becomes easier to manage household budgets and track payments.

- Potential interest savings: If the individual qualifies for a lower interest rate, they could save money on total interest costs.

- Lower monthly payments: Consolidation may result in lower monthly payments, freeing up cash for other financial goals.

- Credit score improvement: Paying off past-due accounts and maintaining timely payments on the new loan can positively impact credit scores.

- Faster debt repayment: With potentially lower interest rates, more of each payment goes towards the principal, potentially shortening the time to become debt-free.

It’s important to note that while debt consolidation has numerous advantages, it’s not a guaranteed solution for everyone. The benefits largely depend on individual financial situations, credit scores, and the terms of the new loan or credit card.

Key Differences Between Debt Review and Debt Consolidation

Legal protection

Debt review offers significant legal protection to consumers struggling with overwhelming debt. When an individual enters debt review, creditors are prohibited from taking legal action against them or contacting them directly. This protection extends to the consumer’s assets, safeguarding them from repossession by credit providers. In contrast, debt consolidation loans do not provide the same level of legal protection. While consolidation simplifies debt management, it doesn’t shield consumers from potential legal actions by creditors if they default on payments.

Credit access

One of the most notable differences between debt review and debt consolidation lies in credit access. Under debt review, individuals are not allowed to access any further credit. This restriction includes taking out new loans or using existing credit cards and store accounts. The purpose is to prevent further indebtedness while working towards financial recovery. On the other hand, debt consolidation doesn’t impose such strict limitations. Consumers who opt for a consolidation loan may still have the ability to access additional credit, although this depends on their credit score and individual financial situation.

Impact on credit score

Both debt review and debt consolidation have the potential to impact an individual’s credit score, albeit in different ways. Debt review typically results in a flag on the credit report, indicating that the person is under debt review. This can have a negative impact on their credit score in the short term. However, as they consistently make payments and work towards becoming debt-free, their credit score can improve over time. Debt consolidation, on the other hand, may initially cause a slight dip in the credit score due to the credit inquiry and the opening of a new account. However, if managed responsibly, it can lead to credit score improvement through simplified payments and potentially lower credit utilization.

Duration of the process

The duration of debt review and debt consolidation processes can vary significantly. Debt review is generally a longer-term commitment, often lasting several years until all debts are paid off. It involves a structured repayment plan negotiated by a debt counselor, which may extend the repayment period to make it more affordable for the consumer. Debt consolidation, however, can be a quicker process. The consolidation loan typically has a fixed term, which may be shorter than the combined terms of the original debts. However, it’s important to note that while consolidation may offer a quicker path to debt freedom, it doesn’t address the root causes of financial difficulties in the same way that debt review does.

Conclusion

Navigating the world of debt management can be overwhelming, but understanding the key differences between debt review and debt consolidation provides valuable insights to make informed decisions. Both approaches offer unique benefits and considerations, with debt review providing legal protection and a structured repayment plan, while debt consolidation simplifies finances through a single loan. The choice between these options depends on individual circumstances, including the severity of debt, credit score, and long-term financial goals.

Ultimately, the path to financial freedom requires careful consideration and commitment. Whether opting for debt review or consolidation, the journey towards financial stability demands dedication and responsible money management. By weighing the pros and cons of each approach and seeking professional advice when needed, individuals can take meaningful steps to regain control of their finances and work towards a more secure financial future.