Financial distress can be overwhelming, leaving many individuals feeling trapped and uncertain about their future. Debt review offers a lifeline to those grappling with financial problems, providing a structured approach to manage overwhelming debt. This process has an impact on one’s financial health, offering a path towards financial stability and peace of mind.

For those considering debt review, it’s crucial to understand the eligibility criteria and what the process entails. This article delves into the signs that indicate a need for debt review, explains the qualifying criteria, and explores alternatives to debt review. It also provides insights into navigating the debt review journey, equipping readers with the knowledge to make informed decisions about their financial future.

Signs You May Need Debt Review

Financial distress often creeps up slowly, but there are clear indicators that suggest it’s time to consider debt review. Recognizing these signs early can help individuals take proactive steps towards financial recovery.

Missed Payments

One of the most telling signs of financial trouble is struggling to make minimum payments on debts. When individuals find themselves unable to meet these obligations, it’s a clear indicator that their income isn’t sufficient to cover expenses. Ignoring bills or avoiding calls from creditors often follows, which can lead to further complications such as late fees and higher interest rates.

Using Credit for Essentials

Another red flag is relying on credit cards or loans to pay for everyday necessities like groceries or fuel. This behavior indicates that finances are stretched thin and can quickly lead to a cycle of debt that’s hard to break. Similarly, borrowing money to pay off existing debts provides only temporary relief and is not a sustainable solution.

Debt-to-Income Ratio

The debt-to-income (DTI) ratio is a crucial indicator of financial health. This percentage represents how much of one’s monthly gross income goes towards debt payments. A healthy DTI ratio is typically below 36%, with no more than 28% to 35% allocated to mortgage payments. When this ratio creeps up, it signals potential financial instability.

For example, if someone earns a gross monthly income of R25,000 with monthly debt payments of R5,000, it indicates a heavy reliance on debt. This situation may raise concerns about long-term financial stability and the ability to manage additional credit obligations.

Creditor Harassment

Facing harassment from debt collectors is a distressing sign that financial troubles have escalated. When creditors frequently call or send letters demanding payment, it’s a clear indication that debts have become unmanageable. At this point, seeking professional help through debt review becomes crucial to regain control of one’s financial situation and find a structured path towards debt repayment.

Qualifying Criteria Explained

Debt review offers a lifeline to individuals struggling with financial obligations, but not everyone qualifies for this process. To be eligible, applicants must meet specific criteria that ensure they can benefit from and comply with the debt review process.

Age and residency requirements

To qualify for debt review, individuals must be at least 18 years old. This age requirement ensures that applicants have the legal capacity to enter into financial agreements. Additionally, applicants must be South African citizens or have debt within South Africa. This criterion helps to ensure that the debt review process can effectively address the individual’s financial situation within the country’s legal framework.

Employment and income status

A crucial aspect of debt review eligibility is having a consistent income source. Applicants must be employed, receiving a pension, or have some form of regular monthly income. This requirement is essential because the debt review process involves restructuring debt payments based on the individual’s ability to pay. The income must be paid into a bank account, allowing for transparent financial transactions and easier management of restructured payments.

Types of debt included

Debt review encompasses various types of debt, including secured and unsecured loans. However, it’s important to note that certain debts, such as home loans with a 30-year prescription period, municipal debts, TV licenses, and SARS-related debts, are treated differently. These specific debts may not be included in the debt review process or may have different terms for resolution.

Legal status of debts

To qualify for debt review, an individual’s debts must not have progressed to certain legal stages. Applicants cannot already be handed over to an attorney for debt collection, be under sequestration (a form of bankruptcy), or be under debt administration. These restrictions ensure that the debt review process can effectively intervene before legal actions complicate the situation further.

Alternatives to Debt Review

While debt review offers a structured approach to managing overwhelming debt, it’s not the only option available to individuals facing financial difficulties. Several alternatives exist, each with its own benefits and considerations.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This approach can make it easier to manage payments and potentially save money in the long run. However, it’s important to note that qualifying for a consolidation loan may be challenging for those with poor credit scores. Additionally, if the underlying financial habits remain unchanged, it could lead to an even worse financial situation.

Negotiating with Creditors

Individuals can attempt to negotiate directly with their creditors. This proactive approach involves explaining one’s financial situation and proposing a revised payment plan. Creditors may be willing to work out an arrangement, such as reduced interest rates or extended payment terms, to avoid potential defaults. However, this process requires careful preparation, including a comprehensive budget and a well-thought-out repayment proposal.

Debt Administration

Debt administration is a legal process that can help individuals with debts totaling less than R50,000. Under this arrangement, an administrator is appointed to manage the debtor’s finances and distribute payments to creditors. While it can provide relief, the process is often lengthy and has limitations. For instance, it excludes certain types of debt, such as mortgage payments, and the fees involved can be substantial.

Sequestration

Sequestration, also known as bankruptcy, is a more drastic measure. It involves selling an individual’s assets to pay off debts. While it can provide a fresh start, it comes with significant consequences. The process is expensive, requiring substantial legal fees, and it can have long-lasting impacts on one’s financial future. Rehabilitation is only possible after a period of five years, making it a last resort for most individuals.

Navigating the Debt Review Journey

Initial Steps

The debt review process begins with a thorough assessment of an individual’s financial situation. This involves gathering essential documents such as proof of income, bank statements, and a list of expenses and credit obligations. A debt counselor then evaluates the person’s level of indebtedness by comparing their expenses and liabilities against their income. This initial evaluation helps determine if the individual qualifies for debt review.

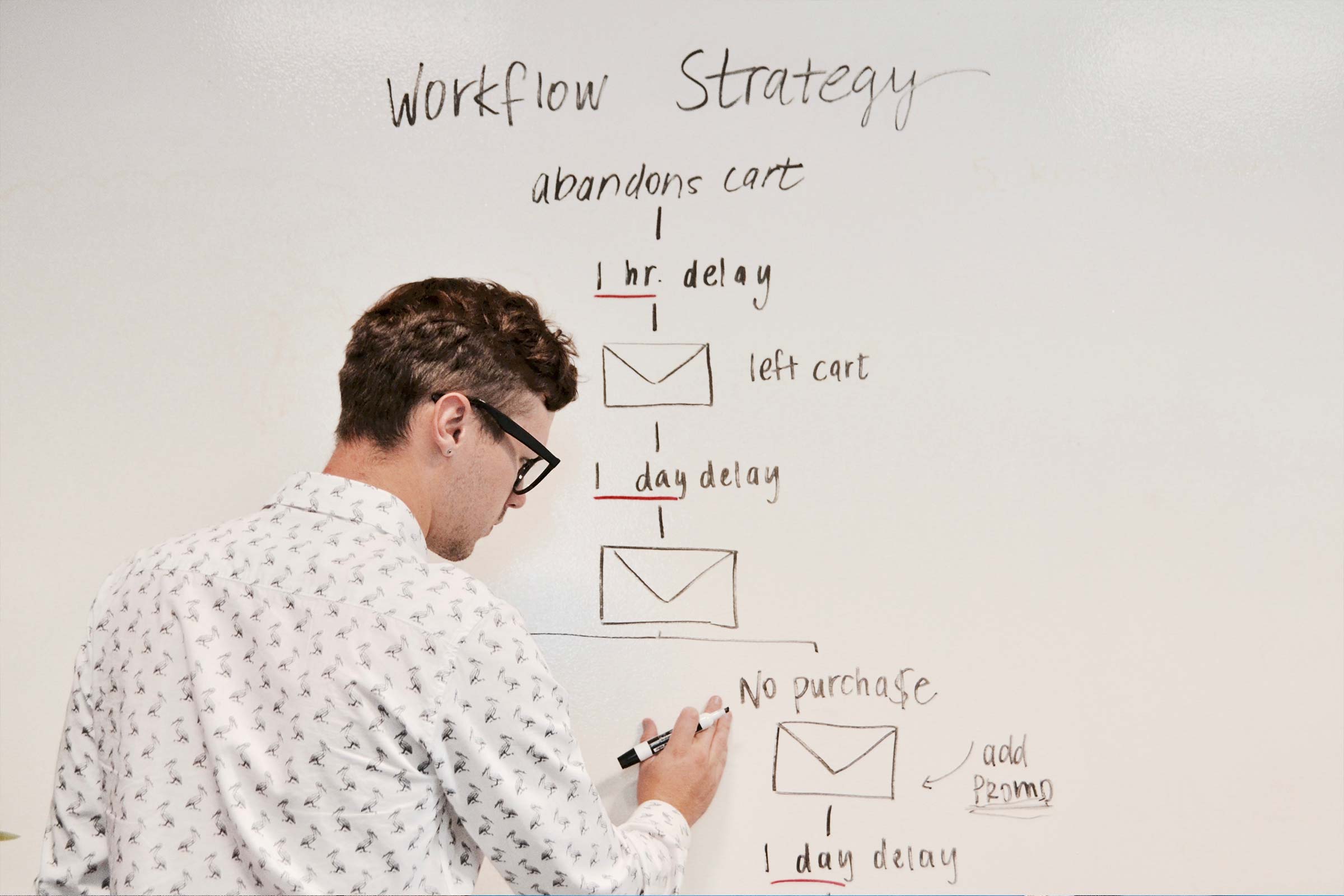

Working with a Debt Counselor

Once eligibility is confirmed, the debt counselor takes on a crucial role. They notify all creditors of the debt review application within five days, using Form 17.1. This notification requests balance statements from creditors and initiates the protection process under the National Credit Act. The debt counselor then negotiates with creditors on behalf of the individual, aiming to secure lower interest rates, reduced fees, and extended payment terms.

Legal Protections

During debt review, individuals benefit from significant legal protections. Creditors are prohibited from taking legal action against the person under review. This protection starts from the moment of application and continues as long as the individual adheres to the agreed payment plan. The debt counselor also informs credit bureaus to flag the person as undergoing debt review, which prevents further credit accumulation.

Completing the Process

The debt review journey typically spans three to five years, depending on the individual’s total debt. Throughout this period, the person makes a single, reduced monthly payment, which is distributed among creditors. Upon successful completion of the payment plan, the debt counselor issues a clearance certificate. This certificate signifies the end of the debt review process and allows for the removal of the debt review status from credit bureaus, marking a fresh start for the individual’s financial future.

Conclusion

Debt review offers a lifeline for those grappling with financial troubles, providing a structured path to manage overwhelming debt. This article has shed light on the signs indicating a need for debt review, explained the qualifying criteria, and explored alternatives to this process. It has also provided insights to navigate the debt review journey, equipping readers with knowledge to make informed decisions about their financial future.

Understanding the debt review process and its alternatives is crucial to regain control of one’s financial situation. Whether opting for debt review or exploring other options, taking action is the first step towards financial recovery. By addressing debt issues head-on, individuals can work towards a more stable financial future, free from the burden of overwhelming debt.